The recovery rebate credit calculator

Ad Do Your Investments Align with Your Goals. If you did not receive a.

Irs Cp 12r Recovery Rebate Credit Overpayment

See the 2021 Recovery Rebate Credit FAQs Topic B.

. They were both single on their 2019 returns. If you claim the head-of. Premium federal filing is 100 free with no upgrades for premium taxes.

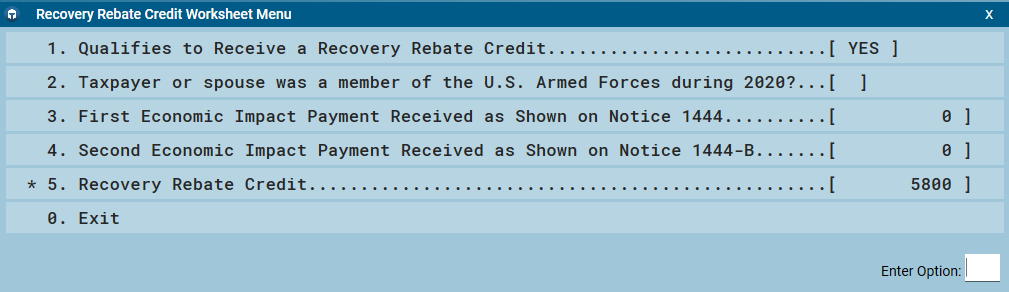

Scenario 3 Recovery Rebate Credit and a new baby. Recovery Rebate Credit Calculator. You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually dont file a tax return.

Americans received a tax-free payment from the US government during 2021 to help recover the economy from COVID-19. Find a Dedicated Financial Advisor Now. Having this information will help individuals.

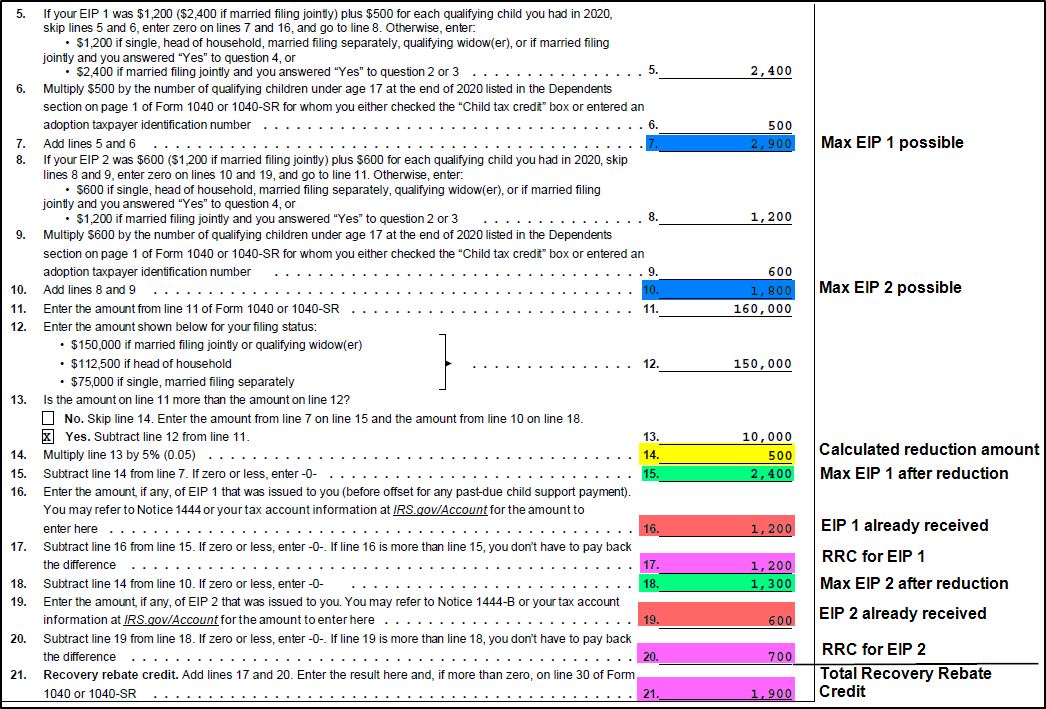

If youre married filing a joint tax return or a qualifying widow er the amount of your second stimulus check will drop if your AGI exceeds 150000. The amount of your recovery rebate credit however is fully determined by the data on your 2021 tax return. Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit.

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020. Your recovery rebate credit is calculated using a base amount. Recovery rebate credit calculator Kamis 01 September 2022 Edit.

If you file a joint 2020 tax return with the same spouse combine your first and second payment amounts to calculate the Recovery Rebate Credit. If you didnt receive a third stimulus check or didnt receive the full amount you can get any money youre entitled to by claiming the recovery rebate tax credit on your 2021 tax. Filed skip or leave blank the Recovery Rebate CreditAmount.

Otherwise enter only your. NerdWallet users get 25 off federal and state filing costs. The Recovery Rebate Credit is calculated based on the taxpayers 2021 income filing status and eligible dependents.

Jo and Nic married in January 2020 and had a baby in October 2020. These payments are referred to as Economic Impact Payments EIP1s. All filers get access to Xpert Assist for free until April 7.

Residents will receive the Economic Impact Payment of 1200 for individual or head of household filers and 2400 for married filing jointly if they are not a dependent of another. Visit The Official Edward Jones Site. The law also provided for an advanced payment of the Recovery Rebate Credit RRC in calendar year 2020.

If you did not receive this. Certain theyhave not received 1st andor 2nd paymentsHelp them calculate their full allowable amount see calculation later. The tax calculator below allows you to estimate your share of the first Coronavirus Crisis related stimulus payments issued to most American taxpayers or residents.

Every United States resident or citizen who filed a tax return in 2018 or 2019 may be eligible to receive a recovery rebate under the CARES Act. New Look At Your Financial Strategy. In addition 500 was paid for each qualifying child for the first EIP 600 for the second and 1400 for the third.

Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate. The gross amount based on either the 2018 or 2019 tax returns of the payment is reduced by 5 for each. Filers are eligible for a 1200 rebate according.

How to Calculate the Recovery Rebate Credit.

Missed Stimulus Check Deadline Don T Worry You Can Still Claim It As A Credit Here Is How Internal Revenue Code Simplified

Recovery Rebate Credit Worksheet Explained Support

Ready To Use Recovery Rebate Credit 2021 Worksheet Msofficegeek

Irs Cp 11r Recovery Rebate Credit Balance Due

Recovery Rebate Credit How Much Can I Claim For 2021 Melton Melton

How Much Money You Ll Get From The 2020 Coronavirus Recovery Rebate

1040 Recovery Rebate Credit Drake20

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca

Recovery Rebate Credit H R Block

Desktop 2020 Recovery Rebate Credit Support

Recover Rebate Credit

Recovery Rebate Credit 2021 2022 Credits Zrivo

2020 Recovery Rebate Credit Topic G Correcting Issues After The 2020 Tax Return Is Filed Nstp

Recovery Rebate Credit Worksheet Explained Support

Recovery Rebate Credit 2022 Eligibility Calculator How To Claim

Recovery Rebate Credit On Amended Return

Recovery Rebate Credit 2021 Tax Return